2,500 Words on the Current Economic Crisis from a Guy who Knows Nothing About Economics.

Many of the good people who bring you this sordid little blog happen to traffic in the world of economics. One guy is an economist. Another guy is working toward his PhD in economics. Others work—or have worked—as economic consultants.

So in these uncertain economic times, to whom in the Isphony family should you turn for guidance and advice? You’re probably leaning toward the economist or the PhD guy, right? Well, they're busy doing economic-type things—supplying stuff and demanding stuff and so forth—so you're stuck with me, a guy with an English degree who never took an econ course; a guy who remains far more-familiar with the exploits of Milton Bradley than Milton Friedman; a guy who giggles whenever he hears someone say “Bernanke.” I may have the same surname as Adam Smith, but aside from a shared love of pure, uncut Peruvian blow, the famed Glaswegian and I have little else in common. But have no fear, my fiscally frightened friends. I may not be able to explain the causes of the current economic crisis—in this bear market, I blame Rex Grossman—but I can give you some advice on how to handle the difficult times ahead. I’ll answer your questions and address your concerns below:

When did you first come to the realization that the economy was going through a meltdown? What were some of the road signs?

Back in aught-eight (or was it aught-seven?), when Wall Street’s vast ocean of liquidity got spiked with a dose of Ice-Nine, politicians and financial observers lined up to try to explain what happened, how it happened, and--most importantly--why it was someone else’s fault. Presidential candidates John McCain and Barack Obama traded barbs over who caused the mess and whose hastily compiled plan could most-effectively fix it. (Ralph Nader, meanwhile, claimed that his soup was too hot before falling asleep in his chair). Federal Reserve Chairman Ben Bernanke (hee hee!) made a few rare TV appearances, where he was often seen pensively stroking his playoff beard, furrowing his brow, and calling for at least six more weeks of winter. Jim Cramer yelled a lot and threw chairs at his Bloomberg terminal, hoping in vain that he could punish the stock market into reversing its precipitous decline. And the handful of economists and investors who managed to avoid the bloodbath stepped to the forefront to rightly claim their place in the pantheon of Those Who Saw It Coming.

I, on the other hand, most certainly did not see it coming. In fact, I hardly noticed it when it actually came. And it took me even more time to discover just how bad things actually were. The extent of the damage was not revealed to me after I stole a hands-over-the-eyes peek at my IRA statement (I refuse to read missives from terrorist organizations). It was not revealed to me when I checked on my stock portfolio, either—mostly because I do not have a stock portfolio. No, I suspected that we were in real trouble when Lehman Brothers—which was not a Jewish plumbing business, as I understood it to be, but rather a giant investment bank—just disappeared. One day, Lehman Brothers was investing stuff and making deals and doing whatever else it is that investment banks do, and the next day they were gone, faster than you can say Crystal Pepsi. Banks holding billions of dollars in assets are not supposed to just implode like some sort of run-down Vegas casino on demolition day, right?

But I failed to realize just how deep the shit was until I watched Lehman ex-CEO Dick Fuld testify before Congress on C-SPAN. Fuld, the once-venerable ruler of a once-venerable firm, sat there sweating like Moses Malone as he tried to explain where all the money had gone. He looked small and defenseless. He sounded uncertain and angry. He had the visage of death on him, and by the end of the session, his bones had been picked clean. His was an ignominious and shockingly abrupt demise, proving the adage that it’s not the fall that kills you, it’s the sudden stop.

And while we’re here, I’m calling for a thousand-year ban on the use of the phrase “Master of the Universe” to describe a member of the financial world’s ruling elite. Sorry, Tom Wolfe. Those white suits of yours are cash money, but I’m not part of the Bonfire of the Vanities generation. I’m part of the He-Man generation, and whenever I hear that phrase—“Master of the Universe”—I do not think a wealthy banker manipulating the markets in a plush office high atop some New York City skyscraper. No, I think of a vaguely Aryan dude who wore a fur Speedo, rode around on a giant cat, and fought epic battles against a skeleton with blue skin. Maybe if Dick Fuld had the Power of Grayskull behind him—instead of a board full of sycophants and a balance sheet full of hot garbage—he could’ve avoided this mess.

What should I do with my money? What are some smart investments to make in the midst of all this uncertainty?

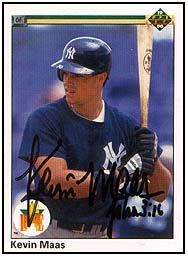

If it’s investment advice you’re seeking, then you’ve come to the right place. I know a little something about personal finance. I have literally dozens of dollars in stock. I know a little something about long-term value, too. Four words: Kevin. Maas. Rookie. Cards.

Here are a few suggestions on what to do with your money right now:

1. Acquire land. Lots of it. Land always increases in value—much like a Kevin Maas rookie card. If you can’t afford to buy any land, then you’ll need to conquer some. Be ambitious—and ruthless. Conquer swaths of the stuff. (Land, it should be noted, can only be conquered in Swaths. 1 Swath = 20 Hogsheads, or 473 Wadlows laid end-to-end).

To conquer these swaths of land, you’ll need an army. Armies are expensive, however, and in these uncertain economic times, a ragtag militia may have to suffice. Don’t worry if you can’t afford to pay your militia. They’ll usually work for a cut of the spoils. Just remind them to pillage before they burn. I cannot stress this enough. Pillage, then burn.

2. Emulate one of the world’s great investors. Warren Buffett recently floated Goldman Sachs $5 billion in order to prop up their sagging balance sheet and kickstart investor confidence. This little “infusion of capital” was also designed, in large part, to eventually give Warren Buffett a boatload of money. (Many of the things that Warren Buffet does are structured with this end goal in mind. He would be a highly devious Secret Santa, I think). With this particular deal, Warren placed a massive bet that Goldman’s stock price will, at some point, go up. By giving them $5 billion, Warren made Goldman’s stock price go up. It has since gone down, but Warren ain’t scared. Warren Buffett moves markets. It’s what he does. He's the John-John Mackey of investors. He pulls his money out and he’s like “What’s up, markets?” and the markets are all like “Not much, Sir” and Warren’s like “Get in the kitchen and make me a sandwich, bitches.” And they do. The world’s financial markets make Warren Buffett a sandwich.

But you are not Warren Buffet. Hell, you’re not even Warren Sapp (let’s be honest—your sack dance needs work). You don’t have millions—or billions—of dollars to throw around, and Byron Trott stopped taking your phone calls after the Haywood Jablome incident in 2007.

Byron Trott never did like you. Remember when you got really drunk at the Goldman company picnic and you kept calling him Byron Scott? No? Well, Byron does.

So how can you be like Buffett? How can you Buy Low and Sell High and rake in the cash? Isn’t investing in the stock market a rich man’s game, like Baccarat or cognac pong? Not at all. The stock market is tanking, and stuff is really cheap right now. You don’t need to be swimming in dollars to find some great bargains. And so, without further ado, here are a few surefire stock tips, brought to you by the guy who traded for Josh Hamilton in a fantasy baseball league back when Hamilton was on pace to hit 50 home runs and drive in 170 runs (Final stats):

General Electric (current price: $13.96): When Jack Donaghy finally takes over, this baby will rise. Believe it.

Diageo (current price: $54.13): Diageo is the largest booze company in the world. In uncertain times, people often turn to alcohol to help them cope. People do this in decidedly certain times, too. What I’m trying to say is: Whiskey is delicious.

General Mills (current price: $60.58): General Mills owns Nature Valley, maker of the exceedingly delicious Sweet and Salty Nut Granola Bars. If you have not tried these culinary masterpieces, you need to do so right away. They consist of nothing more than nuts and granola, lovingly compressed into bar form and enrobed in icing. I had three of them this morning. It’s about time Big Granola latched onto the deliciousness of contrasting flavors. When the rest of the world gets on board, the sky’s the limit.

You’re welcome. Share those dividends.

This financial mess sounds like it’s going to get a whole lot worse before it gets any better. How can I prepare for the lean times ahead?

You’re right. The next few months—years, even—could be pretty rough. And if you’re looking for some advice on how to weather the coming storm, then you’ve once again come to the right place. I’m no stranger to lean times. I was frugal before it was cool. How frugal am I, you ask? Well, I make my own gas. (It’s an old family recipe: 4 parts, gas siphoned from neighbor's car; 2 parts, gas stolen from nearby gas station. "Pay Inside"? Don't mind if I do!). I steal bread from pigeons—and sell it to seagulls. I save all of my cans and bottles and then, once a year, I take a trip to Michigan to get that ten-cent deposit. I’m frugal because I have known poverty. I have known it well. During my junior year in college, I blew all of my savings on the finer things in life—malt liquor and public intoxication fines—and I reached a point where I had just $5 in my bank account. After briefly consulting with my financial advisor—my roommate Jon—I withdrew that money to buy a sandwich. (My financial advisor and I were hungry). The sandwich, I’m happy to report, was good. Nevertheless, buying it left me broke, and I was forced to sling rock and prostitute myself in order to survive the rest of the semester. (Actually, I was forced to get off my lazy, perpetually hungover ass and get a job at a local hotel).

Then, after I graduated from college, I worked as a staff writer for a magazine that was, in hindsight, doomed to fail. It was a start-up that never got started, and after approximately six months of unpaid labor, my bank account had dwindled until I had $20 to my name. Thankfully, I had a support network. My gainfully employed friend Jeff kept me knee-deep in booze whenever we went out drinking, and my then-girlfriend (now wife) covered the rent on the apartment we shared until I got back on my feet (she’s still waiting). My point is, I’ve managed to procure booze, food, and shelter in even the leanest of times. If you follow my advice, you can, too.

1. Let’s get this out of the way first: Never empty your bank account to buy a sandwich. I don’t care how hungry you are. The salty deliciousness of lunch meats is but fleeting. Trust me.

2. If you have expensive tastes, now is the time to cheapen them. Do you spend a few bucks everyday on Coke, Pepsi, or any of those other fancy name-brand sodas? Well, Rockefeller J. Moneypants, please allow me to introduce you to Messrs. Nehi and Shasta. (Note: RC Cola is for the truly desperate. Go down that road only if you must).

Other suggestions:

• Steak is expensive. Try Salisbury Steak. Or, if Salisbury Steak is too pricey—the cost of brown gravy tends to rise in times of economic uncertainty—try Salisbury Steak’s less-selective cousin, Frostburg Steak (Maryland humor!).

• Try Pop Rocks as an inexpensive alternative to caviar.

• Champagne? Champale.

• Wine? Cheerwine.

3. Ask yourself: What would Jesus do? As far as I can tell, the Prince of Peace never had a job—and yet he always had robes to wear and food to eat. How did he do it? Simple: He had magical powers. He could turn water into wine, thereby saving tons of money on alcohol. And the good news is, you don’t need to be a major religious figure to perform your own booze-related miracles. You, too, can crank out the homemade hooch. I brewed my own beer a few years ago, and it was a tremendously cost-effective way for my friends and me to get unfathomably drunk.

I brewed my beer using the Mr. Beer home brewing kit. The beers are easy to make—alarmingly easy, actually—and the stout recipe, in particular, produced a potent and toothsome brew that afforded me a powerful, Jager-esque buzz. I should note, however, that the consumption of homebrew can have some rather mysterious side effects, including (but by no means limited to): Invisibility; intense feelings of vulnerability followed closely by an overwhelming urge to subvert the dominant paradigm; temporary homelessness; and superhuman strength. Hand to god: after consuming a two-liter bottle of my homemade elixir, I was able to kill Ganon without using the silver arrow. (I also killed Rich Gannon, but that was a separate incident). As a warning, I should also note that after we drank my entire supply in a single night, the resulting Homebrew Hangover left three of my friends dead and the rest of us wishing we were. But it was a small sacrifice to make in order to save a few bucks on our buzz. I think Jesus would’ve approved.

And if you take one thing away from this lengthy screed, let it be this: Desperate times do not call for desperate measures; they call for resourcefulness. And just remember, as FDR famously said, that even in the worst of times, the only thing we have to fear is fear itself. And alligators. And the total collapse of the world’s financial markets. And crocodiles, which are kind of like alligators, only meaner and faster. But if you follow my advice, you’ll be ready for whatever the next few months (or years) bring. Or, if you simply follow my last bit of advice and load up on homebrew, you’ll be too drunk to care. Just make sure you save some for Adam Smith. Dude gets awfully ornery if there’s no booze around.